How CourseMaker helps you with VAT

CourseMaker uses Stripe's dynamic tax rate calculation to apply UK and EU VAT to any course/membership purchases where the student resides in the EU/UK. When you connect your stripe account, we generate the necessary tax rates in your account (you can spot them by their coursemaker metadata field). We also keep these tax rates updated for you automatically.

When a student from a country in the UK or EU goes to your school checkout, the correct VAT amount is applied based on their billing address and IP address. You can download a report detailing the VAT amounts for easy filing via the Stripe tax reporting feature.

EU & UK VAT are applied by default to any students in those regions.

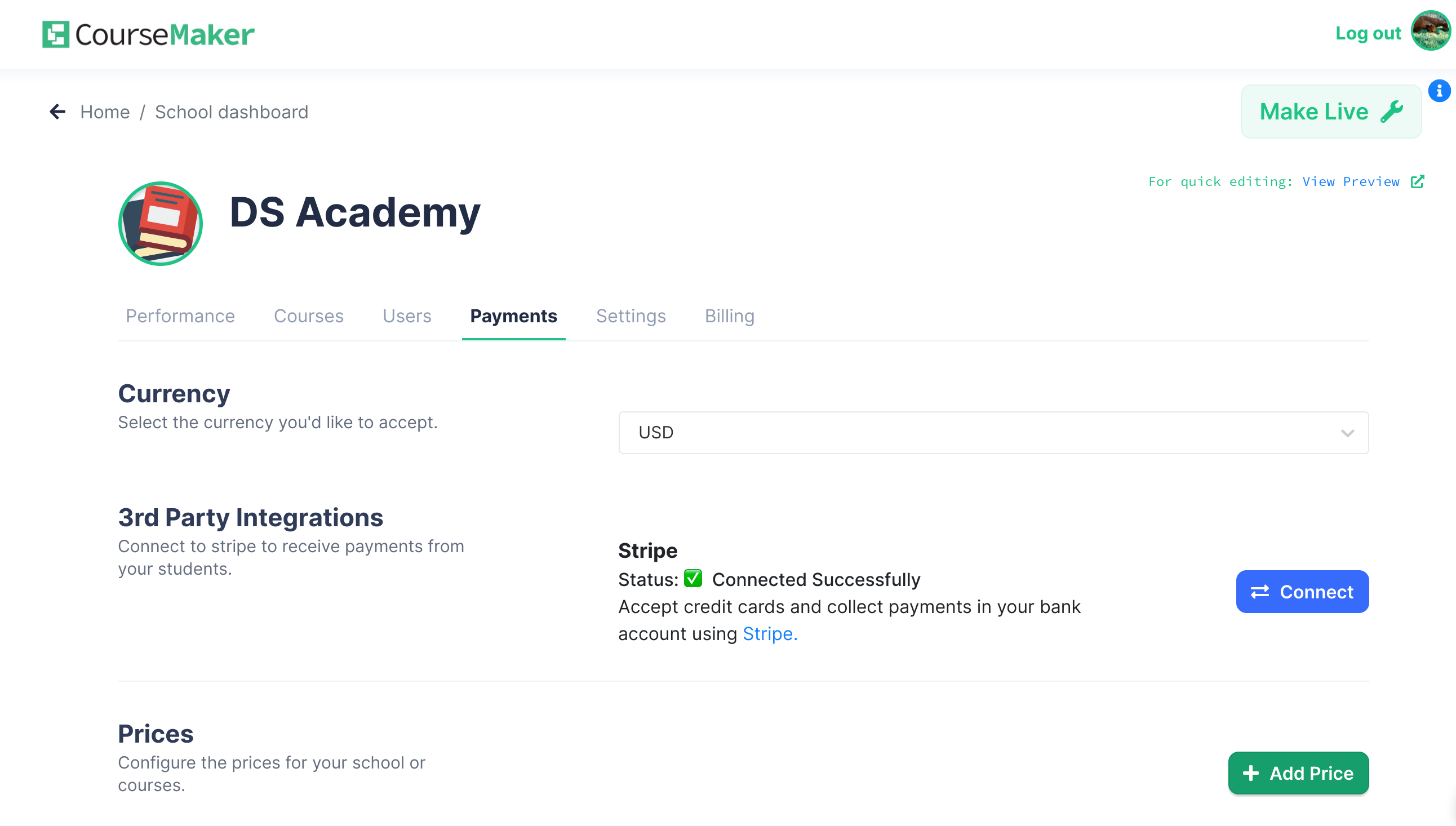

Setting a Price

From your school dashboard go to the "payments" tab and click "Add Price":

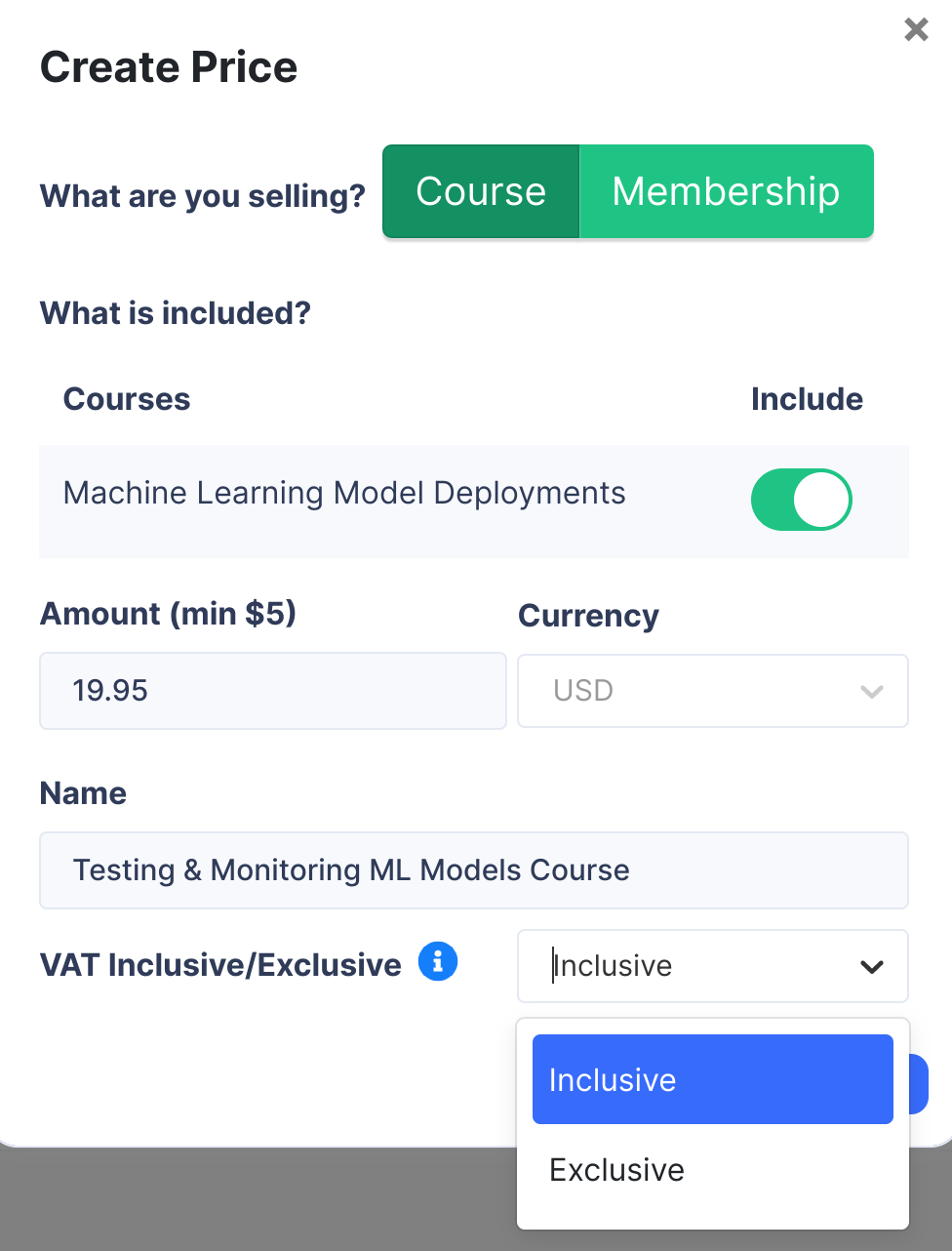

In the add price popup, there is a dropdown to select if EU/UK VAT is inclusive or exclusive (more details below):

Inclusive vs. Exclusive VAT

In the CourseMaker school "payments" tab, you are given the option to specify if a price is "inclusive" or "exclusive" (note that this option is only visible once you have connected your Stripe account):

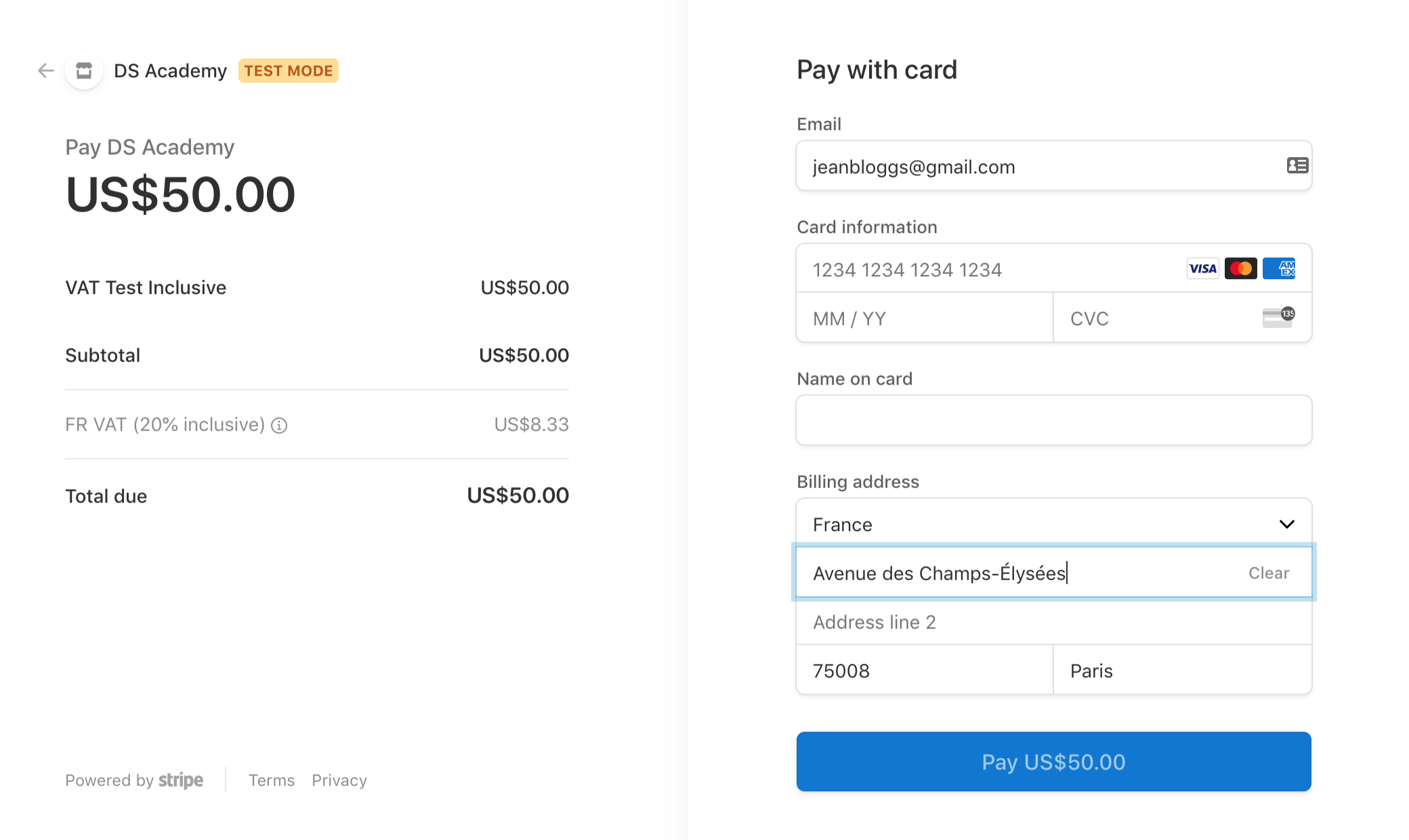

Inclusive pricing

- If you set a price VAT to inclusive, then you bear the cost of VAT. So if your course is priced at $50 and you have a student in the UK (VAT 20%) then your student pays $50 and you owe $10 in VAT.

Your students will see a checkout like this (in this example, the student is from France):

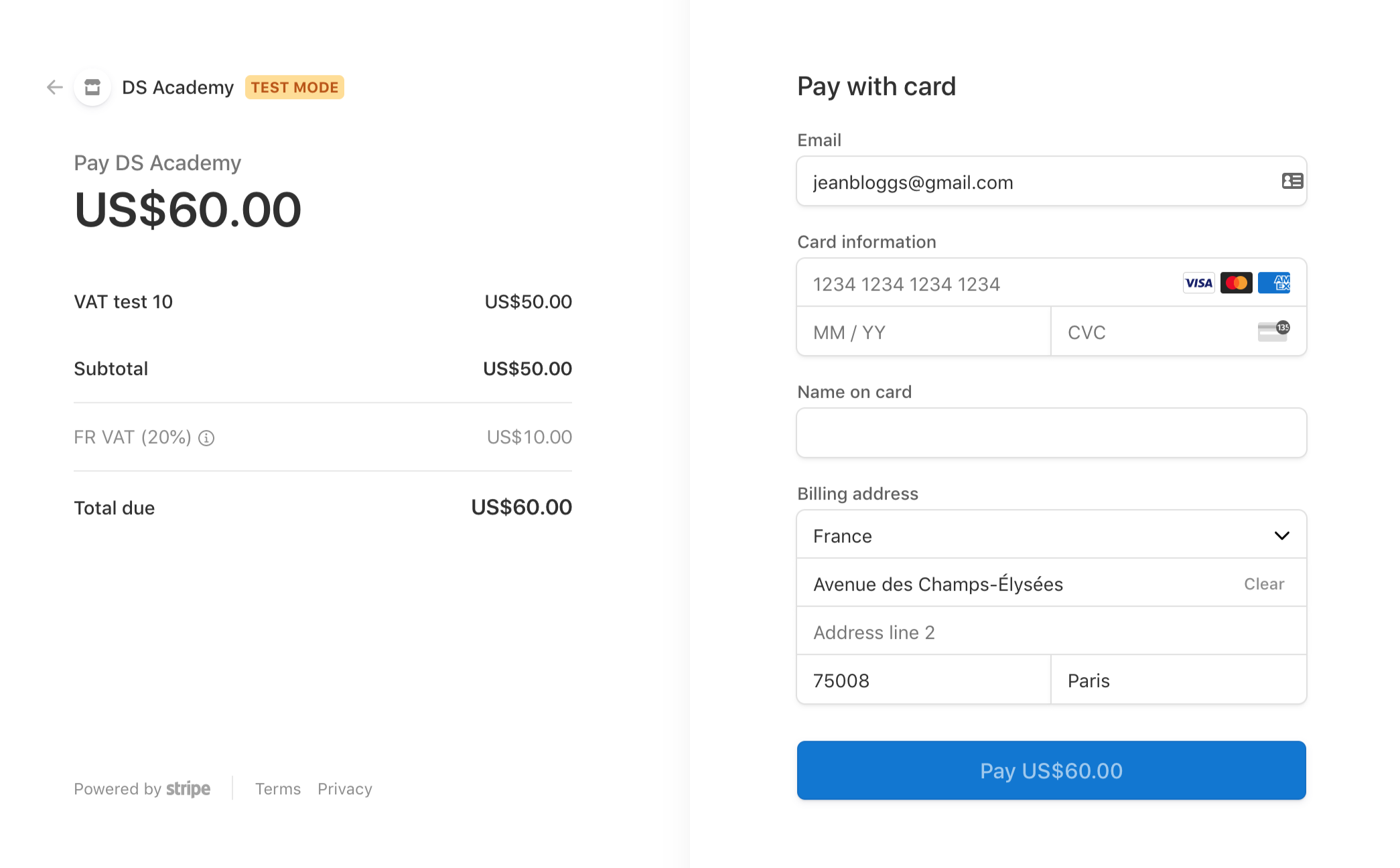

Exclusive pricing

- If you set a price VAT to exclusive, then the student bears the cost of VAT. So if your course is priced at $50 and you have a student in the UK (VAT 20%) then your student pays $60 and you owe $10 in VAT.

Your students will see a checkout like this (in this example, the student is from France):

VAT is never fun. If you have more questions, please email me: chris@coursemaker.org Or if you would prefer to talk over zoom, you can book a call